SMIC to Build a New 28nm Fab in Shenzhen: Production to Start in 2022

by Anton Shilov on March 20, 2021 9:00 AM EST- Posted in

- Semiconductors

- 28nm

- SMIC

- 45 nm

- 40nm

One of the more interesting facets of the ongoing chip crunch has been just how widely it's impacted the fabs and tech companies. The crunch isn't just happening for high-performance leading-edge nodes, as one might expect, but tech companies are also jostling for wafers on much older processes as well. So, with demand for older and more mature manufacturing technologies is still on the rise, SMIC has announced that the Chinese chipmaker intends to build a new 28 nm fab in order to meet the increasing demand for lower-density chips.

The new fab will be located near Shenzhen, and will process 300-mm wafers using 28 nm and larger process technologies. SMIC's goal is to eventually achieve production capacity of around 40,000 wafer starts per month, however the company does not specify when this goal is projected to be attained. Meanwhile, SMIC does disclose that it expects to start production at the new fab sometimes in 2022. The company's manufacturing capacities already operate at a 95.5% utilization rate, so especially during this chip crunch, SMIC is in bad need of additional capacity.

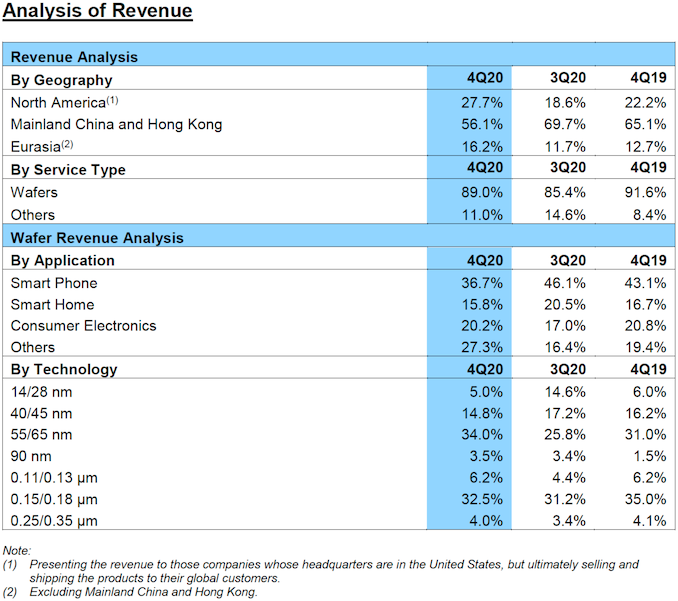

Mature nodes account for the lion's share of SMIC's revenue. Over 95% of SMIC's sales in Q4 2020 were for wafers processed using 28 nm and larger fabrication technologies (see the table below the story). While modern PCs and smartphones rely on primary processors made using leading-edge nodes, they also use a wide variety of support chips produced using older processes. Usually, such chips (e.g., power ICs, display drivers) have a very long lifecycle and are used for dozens of applications. To that end, it makes a great financial sense for SMIC to build a fab that will expand its 28 nm, 40/45 nm, 55/65/ nm and older nodes production capacity.

SMIC said that the estimated new investment for the project will total $2.35 billion. Meanwhile, the company's capital expenditures in 2021 will decrease to $4.3 billion, down from $5.7 billion in 2020 and $5.9 billion in 2019.

Outfitting this new 28 nm fab will be a bit tricky, but overall it shouldn't be too hard given the age of 28 nm technology. Since SMIC is in the U.S. Department of Commerce's Entity List, companies from the USA need to apply for an export license, which runs the risk of being denied even though it's equipment for an older node. TrendForce reported earlier this month that Applied Materials, Lam Research, KLA-Tencor, and Axcelis had applied for appropriate licenses earlier this year, so if the licenses are granted, then SMIC should have little trouble equipping its new fab with new tools. Otherwise, it would have to seek tools elsewhere, perhaps buying them from smaller Chinese chipmakers that ceased to receive aid from the Chinese government last year.

As usual, SMIC will build and equip the new fab in partnership with local authorities, in this case the Shenzhen Municipal People’s Government and Shenzhen Major, an investment company controlled by Shenzhen Municipal. The foundry expects to own about 55% of the fab, 23% will be owned by Shenzhen Municipal and its investment company, whereas the remaining 22% will be owned by third-party investors.

Source: SMIC

12 Comments

View All Comments

Arsenica - Monday, March 22, 2021 - link

"ASML, the largest producer of lithography tools, is based in the Netherlands and does not have to obtain a license from the U.S. government (though some of its products are subject to the Wassenaar Arrangement on export controls)"Not only that but ASML uses light sources from their US-based division (Cymer, for 248nm, 193nm and EUV) that would certainly require an export license on their own.

HyperText - Monday, March 22, 2021 - link

For DUV products it seems that there is no need for a license, apparently.BenFish - Tuesday, March 23, 2021 - link

Licenses are required, they have got clearance for some devices but not the EUV ones.meacupla - Monday, March 22, 2021 - link

A new fab is one thing, but how is the supply chain side of things?Those very high purity silicon ingots and fluorine based chemicals are the major bottleneck, I thought?

EthiaW - Tuesday, March 23, 2021 - link

For mature nodes they actually have domestic suppliers.Oxford Guy - Monday, March 22, 2021 - link

If you fab it they will come.azfacea - Monday, March 22, 2021 - link

"... companies from the USA need to apply for an export license, which runs the risk of being denied ... "it doesnt run the risk of being denied. It will be looked at with presumption of denial. ASML also is not able to ship anything equipment DUV or EUV. And I think 95% chance thats it. Either this plan is going no where or they are planning to make their own tools, which may actually explain why they gone back to 28 nm.

The 5% is for the unlikely event that China is looking to cut a deal with US to allow this. China technically has the power to bully the US if it chooses to. selling weapons to Iran/Venezuela will get some considerable attention. However I say this is unlikely (5%) because china has not acted this way in the past, and no way of knowing how US will react to such an attempt.

chaose - Monday, March 22, 2021 - link

china is trying to reduce their dependence on foreign imports for critical industries, and chips are one of the areas it has identified as a national security interest. This certainly looks like china's going to be pumping money into developing their own chip manufacturing industry so that they aren't at risk of being cutoff from chips (to avoid another Huawei situation).gizmo23 - Tuesday, March 23, 2021 - link

The Renesas fire may give them an incentive to speed up the build process. Demand for automotive is going to stay high for a while. Is that covered in the "Others" category of wafer revenue?JoeDuarte - Tuesday, March 23, 2021 - link

This sentence is confusing: "Since SMIC is in the U.S. Department of Commerce's Entity List, companies from the USA need to apply for an export license, which runs the risk of being denied even though it's equipment for an older node."Can someone explain? What is the DoC's Entity List? I gather it's a bad thing, not a good thing, for the listed entity? At first I thought it was a good thing, because it sounded like maybe a *US* Entity classification, where there would be percent stake by US investors or an investment in the US. It reminded me of the US airline ownership regulations. From the comments, I gather that it's a bad list to be on? Did SMIC do something to get on it, like Huawei's alleged espionage activity or enablement?

Then the part about US companies exporting is unclear and unexplained. What companies? And how are they connected to this story or to the preceding sentence about outfitting a fab? You mean suppliers of fab equipment? And exporting to SMIC specifically? The companies that were listed as having applied for export licenses – are they related to SMIC? Do they supply SMIC? What were they applying for? This announcement from SMIC just came out last week, so I don't understand the connection to these suppliers applying for licenses before the announcement.

I thought ASML, a Dutch company, supplied all the litho equipment. Well maybe not for larger nodes? However, the quote about ASML from commenter Arsenica doesn't actually appear in the article. Did it used to be in the article?