Intel Q2 2014 Quarterly Earnings Analysis

by Brett Howse on July 15, 2014 7:55 PM EST- Posted in

- Intel

- Smartphones

- Mobile

- Datacenter

- desktops

- Notebooks

On July 15, Intel released their Q2 2014 Earnings report for the period ending June 28, 2014.

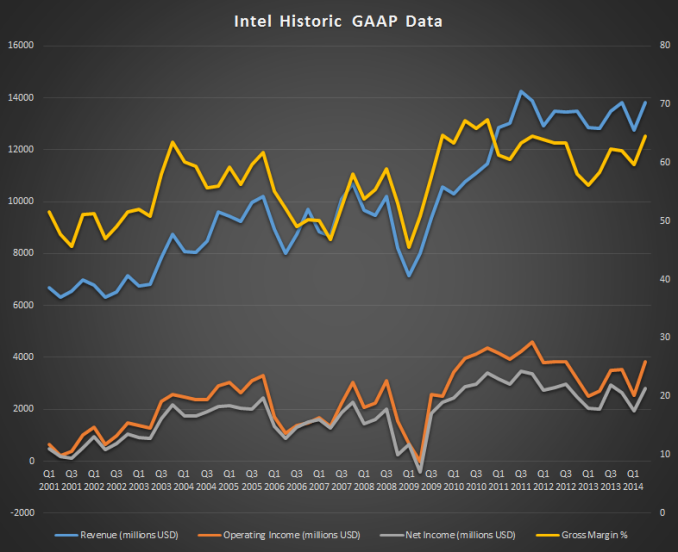

GAAP revenues for the quarter came in at $13.8B which is up almost a billion over Q1 2014, and also up a billion on Q2 2013 for a strong 8% increase.

Earnings Per Share was $0.55, up a substantial 41% year-over-year, and beating analysts’ expectations of 52 cents per share.

| Intel Q2 2014 Financial Results (GAAP) | |||||

| Q2'2014 | Q1'2014 | Q2'2013 | |||

| Revenue | $13.831B | $12.764B | $12.811 | ||

| Operating Income | $3.844B | $2.533B | $2.719B | ||

| Net Income | $2.796B | $1.947B | $2.000B | ||

| Gross Margin | 64.5% | 59.7% | 58.3% | ||

| PC Group Revenue | $8.7B | +9% | +6% | ||

| Data Center Group Revenue | $3.5B | +14% | +19% | ||

| Internet of Things Revenue | $539M | +12% | +24% | ||

| Mobile Group Revenue | $51M | -67% | -83% | ||

| Software and Services Revenue | $548M | -1% | +3% | ||

| All Other Revenue | $517M | -5% | +16% | ||

The stagnant PC sector is finally showing some signs of life again after declining over the last several years. Intel’s PC Client Group reported revenue of $8.7 billion, up 9% over last quarter and 6% year-over-year. Unit volumes of PC Client chips were up 12% over last quarter, and 9% from last year. The average selling prices (ASP) were down 3% from Q1 2014 and 4% from Q2 2013. Most of this can be attributed to a 7% drop in ASP for the notebook platform, where as desktop chips actually slightly increased ASP over Q2 2013.

Data Center revenue was up an even more impressive 19% over Q2 2013, and 14% over last quarter. Data Center volumes were up exactly the same as the PC Client volumes – 12% over the previous quarter and 9% over the previous year, but ASP for the Data Center platforms was up 3% over Q1 2014 and 11% over Q2 2014.

The recently formed “Internet of Things” group continued its strong growth, up again another 12% over last quarter and 24% year-over-year. This group includes embedded segments such as retail, transportation, and consumer focused things like home automation.

The one sector at Intel which continues to struggle is the Mobile and Communications group which was down 61% Q1 2014 versus Q1 2013, and once again in Q2 2014 it was down again 67% compared to Q1 and 83% year-over-year. The silver lining on this is the relatively small amount of revenue this is for Intel with this group only having $51 million in revenue, but in a world where the number of mobile devices is skyrocketing, Intel is struggling to capitalize on the new market. Intel is still not price competitive with the Bay Trail SoC business and are working on a low cost platform for Bay Trail. In the meantime, Intel is subsidizing the platform cost for the time being in order to not be shut out of this market. It’s not something that would be sustainable forever, but it seems to be allowing them a toehold in the mobile market while they continue to push towards lower cost silicon for partners. We’ve seen a lot of mobile devices coming with Bay Trail in the last couple of months, including a $110 Toshiba tablet and this contra revenue is driving that, but hurting the short term results for the Mobile group.

The last sector at Intel to report was the Software and Services, coming in at $548 million in revenue which is pretty much flat quarter-over-quarter and year-over-year. This segment includes McAfee which was purchased by Intel in the not so distant past.

The forecast for next quarter and the rest of the year has been upgraded, with Q3 2014 being forecast for $14.4 billion plus or minus $500 million. The board has also approved an additional $20 billion in share repurchases, with an expectation of $4 billion in shares to be repurchased in Q3. Looking back historically, Intel is once again getting close to record revenue and incomes, having almost fully recovered to 2012 levels.

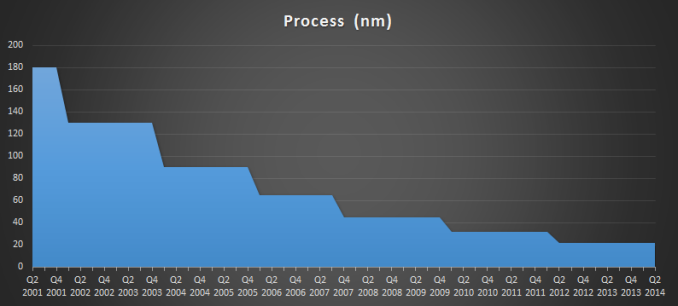

Broadwell is now expected during the holiday season 2014, which is certainly much later than hoped. Going back to 130 nm and coming forward until 32 nm, Intel has averaged 8.2 quarters between process nodes. They have been on 22 nm for nine quarters already, meaning the wait between 22 nm and 14 nm will be about 11 quarters which will be the longest time on a single process node since Intel began the tick tock strategy. Clearly there are some heavy engineering hurdles to overcome as we move towards smaller and smaller processes. We’ll have to watch and see if this delays Skylake or if Broadwell has a shorter than expected lifespan. 10 nm is on the roadmap for 2016 which might be an aggressive timeline with the time 14 nm has taken.

This was a great quarter for Intel, which is generally a bellwether for the rest of the PC industry. After several years of decline, things are looking more optimistic for the industry. Revenues from Intel were great, but historically they have always done well. The exciting takeaway from this earnings report is the increased volumes in both notebook and desktop sales. Whether this is a turnaround in the market, or just a small correction is tough to tell yet.

Source: Intel

33 Comments

View All Comments

ai744 - Tuesday, July 15, 2014 - link

Quite the load of delusional nonsense you’ve got here.stadisticado - Wednesday, July 16, 2014 - link

I'm...not sure you know how to read financial statements. Also, Anand has no obligation to post any of this - he provided what was relevant - if you want to conduct a witch hunt at least link to the PUBLIC 10-Q which has all the info you're claiming.On your last point, you're insane if you think antitrust lawyers would let INTC buy NVDA. If they would ever let it happen if would have happened in '07-'08 when INTC figured out Larrabee wasn't going to work.

A5 - Tuesday, July 15, 2014 - link

The chart of process vs time is showing a pretty clear exponential decay curve. Barring a miracle, I'd say we're looking at an even longer time between 14 and 10nm.Guspaz - Tuesday, July 15, 2014 - link

Not really... you're forgetting that the gains from die shrinks are exponential. Going from 180nm to 130nm got us 1.9x as many transistors per amount of space, while going from 32nm to 22nm got us 2.1x as many transistors per amount of space.It's the length of time that determines if things are slowing down, and while they did shift, there wasn't really any major change from one period to the next. Some were 7 quarters, some were 10 quarters, but 90nm and 32nm both lasted roughly similar amounts of time (only one quarter difference) and they're the better part of a decade apart. 14nm is the first one to really be slower, so while that might indicate that they're hitting a wall (and that 10nm will also be long in the making), the graph alone doesn't show that.

Kevin G - Wednesday, July 16, 2014 - link

Indeed. One factor not mentioned is the desire to go to 450 mm wafers in that time frame. Producing more per wafer is going to be necessary with the need for more production time due to double/triple pattering.The long 22 nm and 14 nm life spans to allow Intel to recover more on the capital investments into those lines. While the tick-tock time line looks like an exponential decay curve, the price of the fabs looks like an exponential growth curve.

As for 10 nm, it may be the last mass production silicon node. Intel is doing 7 nm prototyping and 5 nm research, but they're unsure they can bring them out of the lab in a cost effective manner. Even if they can get 7 nm to work on a mass production line, as I alluded too it may simply be too expensive to do.

DanNeely - Wednesday, July 16, 2014 - link

What's hammering Intel and forcing a delay in 14nm is the same thing that's resulted in everyone else's 20nm processes being severely delayed (Intel's 22nm was just large enough not to need it). Scaling double patterning from the lab to production has proved much harder than anyone expected and blown everyone's timeline for their next node. This is, hopefully, a one off hit and the Intel's transition to 10nm along with all the half node company's transitions to 12(?)nm will return to the expected 2 year time scale.TheJian - Tuesday, July 15, 2014 - link

http://news.investors.com/technology/071514-708941...Mobile accelerated their loss now to 1.1B. So you're giving away 1.15Billion in chips to make 50mil in revenue. How hard is it exactly to sell an Intel SOC? Over a billion dollars hard I guess...LOL. Buy NV or lose 1.5B per quarter by xmas. AT some point this hurts fab R&D. I mean we're talking 4B+ this year in losses on mobile, and it was almost that over that 12 months already. You're almost losing the cost of a whole fab...ROFL. Claiming you're on track to hit 40mil socs sold for tablets is a joke when you give them all away.

http://www.desktopreview.com/default.asp?newsID=13...

$5B was the expected price of AZ fab that is currently empty in my state ;) Go figure. Open the fab and fab MORE stuff for others or eventually lose your butt to IBM/Samsung/GF (not so much GF but they gain also as IBM develops the tech and sammy/gf run with it, IBM just announced 3B for 7nm and below tech) as ARM cannibalizes some desktop sales (and at some point some server probably too) and yet more notebooks as they amp up perf with 64bit, 20nm that make them OK for low-end desktops at least. Surely at some point NV puts an NV card into an ARM desktop and really competes using OpenGL games pushed by google, valve etc. Surely a steamos port is being worked on for arm by now with close ties of valve/NV on steamos.

MS laying off now soon (thousands) and as soon as ARM marches on desktops I'd expect more as less WINTEL will be needed. Also russia going internal for arm chips, 8 core this year 16 core next year and again NO WINTEL. 700K PC's and 300K servers will no longer be bought every year from WINTEL. Layoffs at MS and an empty fab an Intel while mobile loses over a billion a quarter now. See that writing on the wall? It's yelling at you. Germany going linux too and at some point arm surely along with others due to NSA crap no doubt. NSA crap is really going to hurt usa companies over time (russia chips expected to hit routers & switches at some point to, to avoid spying), and they never should have went as far as they did for no real returns on tapping etc. Under oath they said how many crimes were stopped by all our billions of wasted dollars? ;) Now it's starting to cost our companies big time. Uh oh, I think I hear NSA knocking at my door...LOL.

A5 - Tuesday, July 15, 2014 - link

No one who mistrusts US equipment for NSA reasons is going to use Russian chips. Come on.Kevin G - Wednesday, July 16, 2014 - link

It is true, Intel isn't as agile as it needs to be with SoC variety. They seemingly want to produce one or two jack of all trade SoC's instead of tailoring to the demands of specific OEMs for what they want to do for a specific end product. With Intel opening up their fabs and even licensing their cores to be part of 3rd party SoC's (see Rockchip) this appears to be changing.However, if you are expecting ARM to sweep into the desktop is similar to the promise of Linux on the desktop. They're not going to happen for ultimately the exact same reason: legacy software. That means Windows running on x86 hardware. As demonstrated by many still hanging on to Windows XP after support has ended is an example of just how entrenched Windows + x86 is in the market. Sure, there is demand to move away from it due to MS licensing costs and the price of PC hardware vs. cheaper ARM SoC but competing products are worthless if they don't run the software you need.

The server market is a bit different. While x86 is dominate, that market has broken its dependance on Windows and x86 due to the fall out form the Unix wars a decade ago. Enterprise applications are commonly either open source and/or Java base to shed themselves of OS and hardware lock-in. As such ARM is expected to quickly move into the web server niche. However, the enterprise market values RAS and security, something ARM as a platform has yet to demonstrate in production.

yankeeDDL - Wednesday, July 16, 2014 - link

I mostly agree with you.I do have one comment though: I think that the reason XP is still in use is because people don't care.

There's no fundamental advantage using Windows7, except the "artificial" one imposed by Microsoft which is support.

Obviously, Microsoft makes money selling Windows, not giving "free" support, so it is in their interest to push out new and "better" versions of Windows to push consumers to upgrade.

But the truth is, up until XP, all previous Windows versions were "crap". XP was usable and intuitive. Windows7 is, arguably, better, but if you still had support for it, would you really be compelled to update? A Core2Duo still does a good job for a non-gaming PC, so why update?

That's why they tried to "change the game" with Windows8 (and failed miserably). Now they're already on Windows9. Honestly, who in the world feels that Windows7 is inadequate? It's an OS for crying out loud: I use software, not the OS. As long as it's stable, I'm happy.