Intel Announces Q3 2017 Results

by Brett Howse on October 27, 2017 2:15 PM EST- Posted in

- CPUs

- Intel

- Financial Results

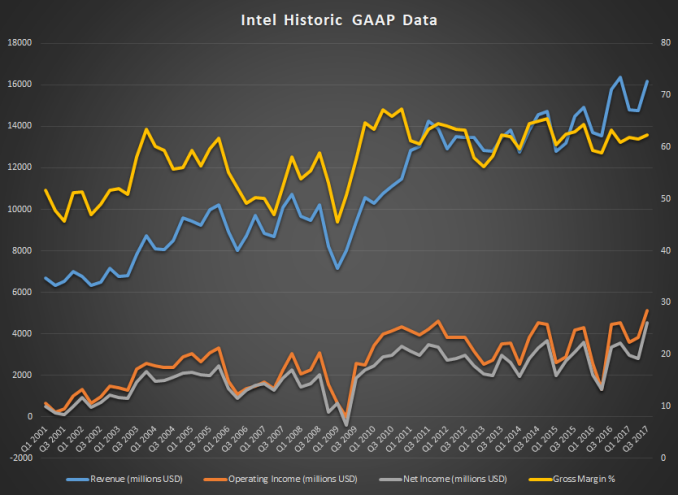

As another quarterly earnings period continues, Intel has announced its earnings for the third quarter of their 2017 fiscal year. Due the slowing of the PC market, Intel has begun its transition to a “Data-Centric Business” which will embrace more than just CPUs. The results have already begun to pay off, which isn’t surprising since they unofficially began this transformation before it was ever announced. At their heart, they are still a chip fab company, but with more reach on what chips they fab, since it's a long way from just CPUs at this point. Let’s dig into the results.

Revenues for the quarter were $16.1 billion, up 2% from a year ago. Gross margin was down 1% to 62.3%, but despite the lower margins, operating income was up 15% for the quarter to $5.1 billion. Net income was $4.5 billion, which was up 34% year-over-year. This resulted in earnings per share of $0.94, up 36%.

| Intel Q3 2017 Financial Results (GAAP) | |||||

| Q3'2017 | Q2'2017 | Q3'2016 | |||

| Revenue | $16.1B | $14.8B | $15.8B | ||

| Operating Income | $5.1B | $3.8B | $4.5B | ||

| Net Income | $4.5B | $2.8B | $3.4B | ||

| Gross Margin | 62.3% | 61.6% | 63.3% | ||

| Client Computing Group Revenue | $8.86B | +7.9% | -0.3% | ||

| Data Center Group Revenue | $4.88B | +11.6% | +7.4% | ||

| Internet of Things Revenue | $849M | +17.9% | +23.2% | ||

| Non-Volatile Memory Solutions Group | $891M | +1.9% | +37.3% | ||

| Programmable Solutions Group | $469M | +6.6% | +10.3% | ||

| All Other Revenue | $202M | +40.3% | -65.2% | ||

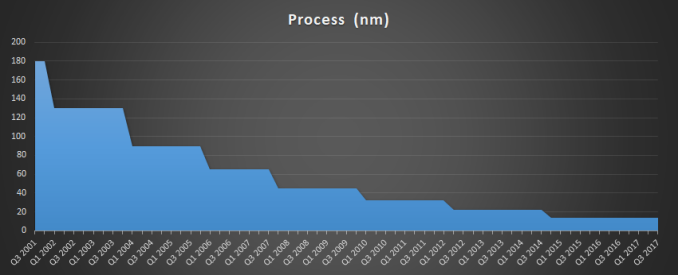

The new “Data-Centric Business” happens to include everything Intel does, outside of the Client Computing Group (CCG), however they’ve not quite shaken the shackles of the legacy PC business quite yet. The CCG had revenues this quarter of $8.9 billion, which is flat compared to Q3 2016. That sounds like it’s not a good thing, but considering the decline of the PC market, Intel has managed to grow this business over the last several years. That’s mostly been driven by demand for their more expensive products, because the only areas where the PC market is doing ok in is gaming, and convertible devices. Operating margins for the CCG were up three points, and the flat revenues were driven by average selling price going up 7%, but unit volumes were down 7%. Operating income for the segment grew 8% though, thanks to improvements in the 14-nanometer process (read: costs continue to drop for this node). Intel has also confirmed that 10-nanometer will be shipping in low volumes by the end of 2017, but higher volume products will be available starting in 2018. Using this as a benchmark, we should expect 10-nanometer to officially launch at CES, but that’s speculation.

The Data Center Group (DCG) had revenue growth of 7% to $4.9 billion, compared to the same quarter a year ago. Operating income for the DCG was $2.3 billion for the quarter, which was also up 7%. Unit volumes were up 4%, and ASP was up 2%. Intel should continue to see growth here as they transition away from the older 22-nanometer parts.

Internet of Things group had revenues go up 23% to $849 million. Intel attributes the growth to strength in industrial and video. Operating profit was $146 million, which is down 24% year-over-year, as they continue to invest in automotive, which many companies are seeing as a strong growth target.

Non-Volatile Memory Solutions Group (NVMSG) had revenues of $891 million, which is up 37% year-over-year. Intel has seen strong demand for data center SSD solutions, and demand is outpacing supply. With the launch of 3D XPoint, they’ve created some new segments, but new products don’t come for free, and this segment had an operating loss of $52 million year-over-year, although that’s $82 million better than a year ago. Intel is predicting this unit to be profitable ahead of schedule, in 2018.

The Programmable Solutions Group, which is Intel’s FPGA business, had revenues up 10% to $469 million. FPGAs have seen a number of new markets, and Intel has found a firm foothold in data center, automotive, and military. Operating profit for this segment was $113 million, which is up 45% year-over-year.

Finally, the All Other group had revenues of $202 million, which is down significantly from a year ago when it was $581 million. Intel has recently acquired Mobileye, and has reported that Mobileye’s results will be in the All Other category going forward.

Looking forward, Intel is expecting revenues around $16.3 billion for Q4, plus or minus $500 million, with gross margin around 61%, plus or minus a couple of points.

Source: Intel Investor Relations

16 Comments

View All Comments

iwod - Friday, October 27, 2017 - link

I couldn't find the link again, but the reason AMD's stock went down were because they didnt answer where and how much the extra money from Fab agreement were. Making the revenue and profits numbers skewed, and hard to tell whether then GPU / CPU were doing well.It seems the impact is limited, at least from Intel's POV.

So why is it so hard to get a Vega and Ryzen now if they aren't selling, the market is shrinking so numbers dont really add up.

Ananke - Friday, October 27, 2017 - link

Intel has around 64-60% of retail CPU market, vs AMD getting around a third in the last quarter. It was like 95%vs 5% a year ago. However, business focus moved from retail to professional and services all over the tech industries, so this change is so negligible, they don't even trace it or report it officially. It does concern only people on web sites like this, i.e. 0.001% of the market/population.guidryp - Friday, October 27, 2017 - link

What do you mean hard to get? Even Vega 56 is fully in stock and selling with rebates.The only thing that keeps going out of stock is Coffee Lake.

eek2121 - Saturday, October 28, 2017 - link

^^ this guy either lives in a fictional world or doesn't know what the MSRP of Vega 56 is...guidryp - Saturday, October 28, 2017 - link

@eek2121You seem to be confused about the difference between availability and priced like you want. There is no more shortage of Vega 56. Fully stocked at Newegg (limit 5/customer) on multiple models.

Price gouging is a different topic, that is just greed from everyone in supply chain, using mining as an excuse to jack up prices.

eek2121 - Saturday, October 28, 2017 - link

(hint: Vega 56 MSRP is $399...the cheapest Vega 56 you will find is $459 and that is NOT an accident....supply, demand, etc...)iwod - Saturday, October 28, 2017 - link

Yes, exactly the same as Ryzen and EPYC, price aren't exactly where they should be. I wonder if this is a retail market distribution problem.msroadkill612 - Saturday, October 28, 2017 - link

$60 USD is not much more than 50gm/2oz of tobacco or 750Ml of whisky here in Oz. Its a lot, but not the end of the world if u must make the jump in the current market.Vega at least is new gen & will keep improving value with drivers and better code.

mapesdhs - Monday, October 30, 2017 - link

Indeed, GN posted some interesting new numbers for Vega after a driver update, Win10 FCU, etc. Not up there with a 1080 Ti, but better than before for sure, better than a 1080 in some cases. However, the power issues still put me off somewhat, though at the same time the absolute cost of relevant NV options is still crazy high. Just a pity the days of using two lesser cards in SLI are kinda gone, with game devs bothering less and less to properly support multi-GPU.yannigr2 - Friday, October 27, 2017 - link

"That sounds like it’s not a good thing, but considering the decline of the PC market, Intel has managed to grow this business over the last several years."Considering that AMD had a nice quarter with significant increase of revenue from their Ryzen processors (I don't believe everything was cryptomining graphics cards), maybe PC market didn't slowed down this last months, but the opposite. That probably helped Intel to grab as much as it needed to cover up what was lost to AMD.